Key Considerations for Choosing a Traditional Financial Planner

The financial advisor you choose can significantly impact your financial success. Before committing to a financial planner, it's essential to assess your needs and preferences. Start by considering the type of financial help you require. Are you looking to kickstart your investment journey, seeking personalized online advice, or opting for traditional in-person financial planning? If you're opting for traditional financial planning, here are ten essential questions to ask your financial professional:

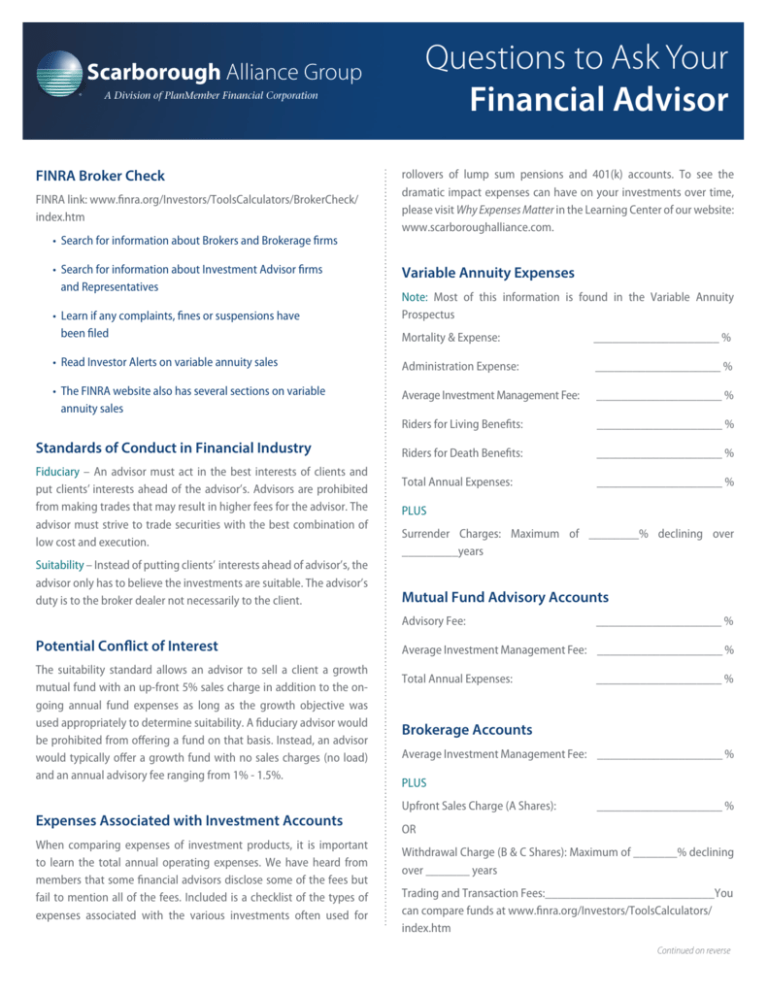

1. Are you a fiduciary?

This question lies at the core of establishing trust and transparency in your financial relationship. A fiduciary is legally bound to act in your best interest, providing recommendations that align with your financial goals and needs. In contrast, non-fiduciaries, such as broker-dealers, may prioritize products that are merely "suitable," potentially leading to suboptimal financial decisions for you. It's crucial to understand this distinction to ensure that your advisor is committed to putting your interests first.

2. How do you get paid?

Understanding the advisor's fee structure is important to avoid potential conflicts of interest. Fee-only advisors, in particular, are compensated solely by their clients and do not earn commissions for selling financial products. This structure aligns the advisor's incentives with your financial well-being, ensuring that their recommendations are based on merit rather than the potential for a commission. Whether the compensation is a percentage of assets managed, a flat fee, or an hourly rate, transparency is crucial.

Read also:Unraveling The Mystery How Old Is Paul Walker A Tribute To A Timeless Star

3. What are my all-in costs?

Beyond the advisor's fees, there may be other associated costs that can affect your long-term savings. These additional costs may include transaction fees, custodial fees, or other expenses related to specific investment products. A comprehensive understanding of the complete cost structure can help you to make informed financial decisions. Encourage your advisor to provide a detailed breakdown of all costs associated with their services. By staying vigilant about potential hidden costs, you can safeguard your financial interests.

4. What are your qualifications?

The financial industry is filled with professional designations, each carrying its own set of qualifications and accreditations. Scrutinizing the credentials of your financial advisor is important to ensure their competence and expertise. Don't hesitate to get into the details. Moreover, checking your advisor's record through a Form ADV can provide valuable insights into their professional history and standing. This document, filed with the Securities and Exchange Commission, offers information about an advisor's business practices, potential conflicts of interest, and disciplinary history.

5. What's your investment philosophy?

Understanding your financial advisor's investment philosophy is fundamental to establishing a successful and enduring partnership. As financial markets experience ups and downs, it becomes important to stick to your chosen investment strategy. A shared belief in the advisor's approach is key to weathering market downturns without succumbing to panic and making impulsive decisions. Selecting an advisor whose philosophy aligns with your values ensures success.

6. What asset allocation will you use?

Diversification is essential for a sound investment strategy. Your financial advisor should articulate a clear plan for asset allocation, incorporating a mix of domestic and international stocks, as well as investments across various market capitalizations. A well-structured portfolio should include exposure to companies of all sizes to optimize returns while managing risk.

7. What investment benchmarks do you use?

Understanding the benchmarks your advisor uses is critical for assessing their performance and aligning expectations. Some advisors may rely on benchmarks that do not accurately represent the nature of their investments. Asking about investment benchmarks ensures that your advisor is tracking performance against relevant metrics, providing a more accurate assessment of their investment strategy.

8. Who is your custodian?

The choice of custodian is an important factor in safeguarding your investments. Ideally, your financial advisor should employ an independent custodian, such as a reputable brokerage, to hold and manage your assets. An independent custodian acts as a safety check, allowing you to verify the accuracy of reported performance data and account balances independently. This transparency fosters trust and ensures that clients can verify their financial standing at any given time.

Read also:Kat Timpf Net Worth A Detailed Insight Into Her Wealth Career And Achievements

9. What tax hit do I face if I invest with you?

Understanding the tax implications of your investments is paramount to making informed financial decisions. By questioning your financial advisor about potential tax implications and fees, you gain insight into the overall impact on your net returns. It is important to know what you get to keep after accounting for fees and taxes, providing a clearer picture of your estimated net return.