While high inflation has troubled millions of Americans, there is some good news coming the way of taxpayers. This year, several households can look forward to getting a smaller tax bill. The IRS annually adjusts the federal income tax bracket and standard deduction and this year, taking high inflation into account, the IRS has provided some relief for people. While the new rates help individual taxpayers, joint filers (married couples) are set to benefit more from the new changes.

What are the tax brackets for 2024?

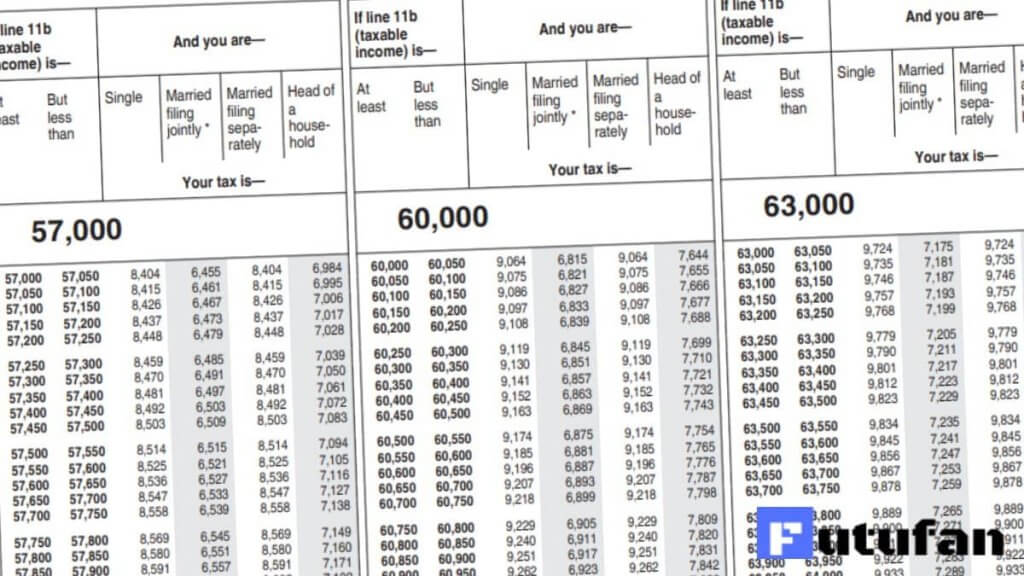

The IRS set federal income tax brackets for 2024, with earnings thresholds for each tier moving up by about 5.4% for inflation. The agency adjusts the tax brackets using a formula based on the consumer price index, which tracks the costs goods and services typically bought by consumers across the U.S. While the tax bracket increases are less than 2023, when the brackets shifted higher by about 7.1%, a historic increase, it is still a significant rise that would help out taxpayers.

Tax brackets for single individuals:

10% for incomes of $11,000 or less

Read also:Unraveling The Mystery Is Kirk Russell Still Alive

12% for incomes greater than $11,600

22% for incomes greater than $47,150

24% for incomes greater than $100,525

32% for incomes greater than $191,950

35% for incomes greater than $243,725

37% for incomes greater than $609,350

Read also:Costco Gave Its Customers A Trendy Glass Bottle For Free Heres Why They Didnt Want It

Tax brackets for joint filers:

10% for incomes up to $22,000

12% for incomes greater than $22,000

22% for incomes greater than $89,450

24% for incomes greater than $190,750

32% for incomes greater than $364,200

35% for incomes greater than $462,500

37% for incomes greater than $693,750

Why are tax bills low in 2024?

As the IRS makes tax code changes to account for inflation, it helps prevent "tax bracket creep," which pushes taxpayers into a higher tax bracket, despite inflation impacting their wages and purchasing power.

Thus, with the higher brackets, even if taxpayers make more money in 2024, they will not be pushed into a higher tax bracket. The inflation-factored tax code may even push taxpayers into a lower tax bracket allowing an increase in their take-home pay. For instance, in the 2023 tax year, single tax filers will pay 10% on their first $11,000 of taxable income and 12% for incomes above it. However, in 2024, the first $11,600 of taxable income will fall into the 10% tax bracket, allowing $600 of additional income to be taxed at the 10% rate instead of 12% in the current tax year.

Further, the standard deduction is also increasing by 5.4% in 2024. This means that the standard deduction for married couples filing jointly will rise to $29,200, an increase of $1,500 from the current tax year. Single taxpayers will benefit from a standard deduction of $14,600, which is up by about $750 from the current tax year. Also, heads of households will have a standard deduction of $21,900, which is an increase of $1,100 from the current tax year, according to CBS News.

Important dates for tax filing

Taxpayers in most states will have until April 15 2024, to submit their returns or request an extension. This year, the IRS expects to receive more than 128.7 million individual tax returns by the deadline. Also, taxpayers who want to receive their refund within 21 days of filing, must file their return electronically, ensure that it is accurate and complete, and request to receive the refund via direct deposit, the IRS said.